|

|

|

|

|

|

Did You Know?

Veterans Lose Benefits Hundreds of veterans and their families are trying to figure out what they'll do. Now that the Department of Veteran's Affairs has run out of money to pay for programs some vets use daily and their families said they can't go without. For example, a third of the people who go to Tabitha adult day services in Lincoln, Nebraska are veterans. By the end of July 2015, they have to find a way to pay about $1,000 a month to keep going there. The federal government cut funding to some services to keep others. The U.S Department of Veteran's Affairs ran out of money at the end of June 2015 for services, like adult day services, that don't require a certified practitioner. For more information see your VSO or call 1-800-827-1000.

Special Vouchers for Veterans

More than 300 public housing authorities throughout the United States recently received special vouchers for homeless veterans, to help place them in a more permanent living situation. The program comes from the White House and the Department of Veteran Affairs (VA) joint initiative to end veteran homelessness by December 2015. Veterans may qualify only by a referral from the VA for the VA Supportive Housing Voucher. Call 1-800-827-1000 for more information.

No Credit Check Through the federal government employee shopping program, PayCheck Direct® helps veterans buy what they want and need today, then make interest-free payments over 12 months. Now is a good time for veterans to shop for what they want to make their great outdoors greater. With PayCheck Direct, veterans get: interest-free financing, low convenient payments and no credit checks. Veterans can shop for thousands of name-brand products.

Veterans & Active Duty Servicemembers May Be Eligible for This Compensation

Some of the largest banks in America entered into an agreement with federal bank regulators concerning their foreclosure practices during the housing crisis. This has resulted in cash payments to qualified military members and veterans. Bank of America, Citigroup, JPMorgan Chase and Wells Fargo are some of the financial institutions that have reportedly seized homes from military members. These lenders often utilized faulty documentation in evicting the service men and women, some of whom were serving in active war zones and making them victims of mortgage fraud. These complaints have sparked national outrage and reports indicate the number of military mortgage fraud victims may be in the thousands.

Fact: These foreclosures are a direct violation of the Service Members Civil Relief Act. The Service Members Civil Relief Act forbids foreclosure for any active member of our military without an explicit court order. Military members may be entitled to significant compensation based on violations of the Service Members Civil Relief Act. Click here for Free evaluation.

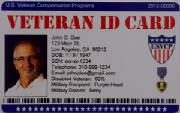

Crime To Call Yourself A Veteran

Pretending to be a military veteran to obtain a discount or other benefit not only is considered wrong by most Americans, it also now is a crime in Indiana. Republican Gov. Mike Pence signed into law Tuesday, March 22, 2016, House Enrolled Act 1179, sponsored by state Rep. Chuck Moseley, D-Portage, making "stolen valor" a misdemeanor crime punishable by a $5,000 fine or up to one year in jail.

|

|

|

|

|

|

|